Institutional Investors Return With Renewed Confidence

After months of market uncertainty, institutional investors are re-entering the crypto space with stronger conviction. Hedge funds, asset management firms, and pension portfolios are gradually increasing their exposure to Bitcoin, Ether, and tokenized investment products.

Analysts attribute this renewed confidence to:

-

Growing regulatory clarity in major markets

-

Improved custody solutions

-

Lower market volatility

-

The rise of tokenized financial products

Market strategists expect institutional capital to be one of the biggest drivers of crypto growth throughout 2026.

Bitcoin’s Strength Signals Market Stability

Bitcoin continues to demonstrate resilience, with steady demand from both retail and institutional buyers. Increased interest in long-term holding, rising on-chain activity, and broader adoption of Bitcoin payment solutions point to strong market fundamentals.

Industry experts project that Bitcoin’s liquidity and global accessibility will make it one of the most influential financial assets of the next decade.

DeFi Experiences a Second Wave of Innovation

The decentralized finance ecosystem is experiencing renewed growth as developers roll out advanced use cases beyond traditional lending and staking. New DeFi platforms are focusing on:

-

Real-world asset tokenization

-

Decentralized credit scoring

-

Institutional-grade liquidity pools

-

Cross-chain lending mechanisms

The second wave of DeFi innovation is expected to bring structured financial products into decentralized markets, increasing trust and participation.

Altcoins Drive Utility Through Real-World Use Cases

Altcoins are shifting away from hype-based cycles and moving toward utility-driven development. Several leading blockchain networks are expanding their real-world integrations across industries including healthcare, logistics, gaming, and digital identity.

Key trends shaping altcoin growth include:

-

Scalable layer-2 networks

-

Improved smart contract security

-

High-throughput architectures

-

Cross-chain interoperability

This shift toward usability signals the start of a more mature and sustainable altcoin market.

Crypto Regulations Tighten But Create New Opportunities

Global governments are implementing updated regulatory frameworks for crypto trading, stablecoins, Web3 applications, and tokenized assets. While stricter rules introduce new compliance requirements, they also establish a more stable foundation for mainstream adoption.

Key regulatory trends include:

-

Standardized reporting for exchanges

-

Consumer protection measures

-

Clearer guidelines for stablecoin issuers

-

Frameworks for tokenized financial products

Industry leaders believe that balanced regulation will accelerate innovation rather than restrict it.

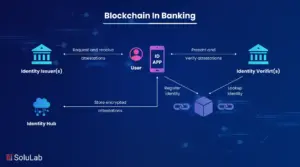

Web3 Growth Expands Across Gaming, AI, and Digital Identity

The intersection of Web3, AI, and metaverse technologies continues to shape the next generation of digital experiences. Crypto-powered gaming, AI-driven NFTs, and blockchain-based identity systems are gaining widespread interest.

Notable developments include:

-

Growth of play-to-earn and social gaming ecosystems

-

AI-generated digital assets

-

Secure decentralized identity platforms

-

Web3-powered creator economy tools