The cryptocurrency market is showing renewed momentum this week as global adoption increases, new blockchain technologies emerge, and major companies prepare to integrate digital assets into their business models. Analysts say the final quarter of 2025 could be one of the strongest periods of growth for the crypto industry in recent years.

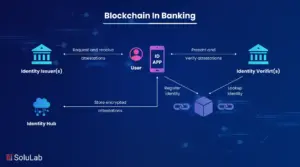

Major Companies Move Toward Crypto Integration

Several international corporations are exploring crypto payments, blockchain loyalty programs, and tokenized services. Retail, travel, and entertainment companies are conducting pilot tests where users can pay with Bitcoin, stablecoins, or network-specific tokens.

The shift reflects a growing belief that crypto offers:

-

Faster and cheaper international payments

-

Better customer engagement

-

New digital revenue models

-

Stronger security and transparency

Experts predict that by mid-2026, many global brands will integrate some form of Web3 technology.

Stablecoins Expand in Cross-Border Commerce

Stablecoins continue to gain widespread acceptance in developing economies and cross-border commerce. This week, digital payment providers reported a surge in stablecoin usage for remittances and online trade.

Factors driving growth include:

-

Lower transaction fees compared to banks

-

Faster settlement times

-

Easy access through mobile wallets

-

Rising distrust in local currencies in certain regions

Economists believe stablecoins could soon become a major part of daily financial infrastructure.

Ethereum and Layer-2 Networks Push Scalability Boundaries

Ethereum’s ecosystem is evolving rapidly as layer-2 networks continue to advance performance. Several scaling solutions introduced major upgrades focused on cheaper fees, faster confirmation speeds, and improved developer tools.

Key improvements include:

-

More efficient rollup architectures

-

Optimized zero-knowledge proofs

-

Better smart contract security

-

Cross-chain interoperability features

Developers say these upgrades will make Web3 applications more accessible to millions of new users.

Crypto Security Strengthens as AI Tools Detect Threats Early

Cybersecurity firms are implementing AI-powered systems that analyze blockchain transactions in real time to detect unusual activity. Early reports show a significant reduction in major hacks and rug-pull incidents compared to previous years.

Security innovations include:

-

Automated threat detection

-

Contract vulnerability scanners

-

Wallet attack simulations

-

AI-driven fraud alerts

This marks a turning point for Web3 security, addressing one of the industry’s biggest concerns.

Bitcoin Adoption Surges Amid Growing Geo-Economic Uncertainty

Bitcoin demand is steadily rising as global investors seek safe-haven alternatives in the face of economic uncertainty. With increasing geopolitical tensions, unpredictable inflation, and currency instability in certain regions, Bitcoin continues to act as a digital store of value.

On-chain data indicates:

-

Rising long-term holder accumulation

-

Higher transaction activity

-

Increased institutional inflows

-

Strong support from global retail buyers

Market experts believe Bitcoin may enter a new adoption cycle in early 2026.

Regulators Tighten Oversight, But Industry Welcomes Clarity

Governments worldwide are refining crypto regulations to improve consumer protection and reduce financial risks. While oversight is increasing, industry leaders view the new rules as necessary steps toward mainstream adoption.

Current regulatory focuses include:

-

Clearer exchange licensing requirements

-

Stablecoin reserve transparency

-

Anti-fraud measures

-

Tax reporting guidelines

The greater regulatory clarity is expected to attract more traditional investors and financial institutions.